As always, the preliminary work is done ahead of time, in the form of establishing my baselines for both the nearest demand level and the nearest supply level. Because of the recent market action with all the large gaps, I now weight overnight data rather significantly. This is simply because if I were not to look at overnight market, there are large runs of price where I would not be seeing any levels, even if a level existed.

In this case, the 60 minute chart below clearly revealed clean demand and clean supply.

I always start analysis for intra-day trading with a larger intra-day time-frame; usually a 30 or 60 minute chart. There is no reason for one time-frame over another, other than being able to clearly see the levels. As so often has been happening, a key level (read: key opportunity) triggered in the overnight, so I missed the trade that occurred as price came up and touched the supply level.

While that was indeed the best opportunity, with the lowest associated risk, another opportunity can be gleaned by applying market logic. While not 100%, it's a very strong likelihood that when a supply level is touched and rejected, the opposite demand level will probably be visited by price. Additionally, because the supply and demand levels are relatively far apart, there is plenty of room for price to move down, opening up a margin of profit for a potential trade.

Armed with this knowledge, I immediately began stalking a short trade. I brought up the 2 minute chart below...

On a small scale, I found the perfect storm to take a short trade. Just a couple bars previous to the most current bar on this chart, price made a mini-rally up to and just broke the prior pivot high. Price did this, in the process moving into a range of price bounded by the momentum move just previous. Immediately, this price was rejected. This all happened in the larger time-frame context outlined above.

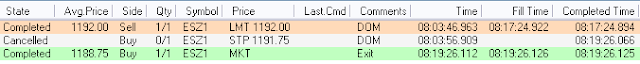

Without hesitation, I went short 2 contracts at the market. My stop was just above the most recent pivot high (bar prior to entry bar, which is marked with the magenta down arrow). The payoff is displayed graphically below. Please note that no other form of confirmation was used. The more confirmation a trader seeks, the higher the risk involved. A corollary to this is my STRONG belief that the ENTRY is all important; NOT the exit. I realize this is a somewhat controversial statement. However, if one carefully walks through the logic, this belief becomes inescapable if one is to become truly successful as a trader.