After a long summer break from trading, I opened the charts this morning just before the open. I hadn't done any real homework, so before even considering a sim trade (which is all I would do first day back after such a long break) I would at least need to locate the trade-able supply level above and demand level below. I took a quick glance at a daily chart to see price in the emini S&P is in a trading range. So, I zoomed into to the 30 minute chart you see below.

This is a 30 minute chart and I drew a rectangle around an area that price was showing some degree of acceptance in. Immediately following was a very wide range candle. That wide range can ONLY happen because the price acceptance area marked had a hidden imbalance between willing buyers and willing sellers.

Now, one could just attempt to short this market when/if price retraces to the origin of the imbalance. However, a protective stop would realistically need to be placed just above the upper limit of the rectangle. In this case, that's a pretty good size stop. So, let's zoom in again; this time down to a 5 minute chart...

The larger rectangle shows the same area of interest as on the 30 minute chart. The smaller, blue shaded, rectangle shows a micro-acceptance zone. From that zone, we can see the exact origin of the move down. That's exactly where the imbalance occurred. And, exactly where we'd want to take a trade from. Here's what the trade result looked like...

Readers of my blog will note I've done this trade with only price action. No order flow indicators, no indicators of any sort. Not even volume. As a trader builds skill, much of the other stuff becomes like training wheels; especially when the origin of the imbalance is so clear cut. However, I promise you I'll be looking at all my order flow indications from the Footprint chart and the Volume Breakdown indicator as I fully get back into trading.

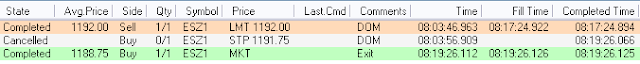

When I don't have access to the order flow indicators, I'll usually only take a trade with a clear imbalance (as in this case) and simply enter using a limit order (again, as in this case).

There is something else to look at here. Check out the 5 minute chart below. Look at all the green candles screaming up to my proposed entry point. The trend, to anybodies eyes, at that point is up. And I'm going to short! Also, consider that a significant news report was being release as price rallied into this level. Think about the emotions you might be experiencing: second-guessing? fear? worry? doubt? Those are the emotions that need to be conquered to consistently participate in such successful trades.

Shorting under these circumstances can feel most uncomfortable. Yet, it's the safest place to enter. Accepting that paradox into you trading personality is perhaps the single most powerful self improvement you can work on. Look at the pay off in just minutes...